In March 1921, the Washington State Legislature imposes the state's first gasoline tax. In turning to highway users to fund road construction and maintenance, Washington follows the lead of Oregon, which imposed the nation's first gas tax in 1919. Washington's one-cent-per-gallon tax adds around $900,000 per year to the Motor Vehicle Fund.

A Breakthrough for the Autos

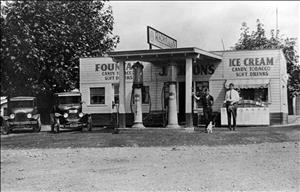

As automobiles became less expensive and therefore more common in the early 1920s, the demand for more and better roads outstripped the state's existing revenue sources for highway construction and maintenance -- primarily a one mil property tax levy, along with special levies and assessments. (A mil is one-thousandth of whatever is being assessed.) Other states faced the same dilemma, and in 1919 Oregon became the first to link highway funding with highway use by imposing a tax on gasoline.

The gas tax was a breakthrough for highway officials and the growing automobile industry. It ensured that revenue would rise as highway usage did, without increasing the burden on property owners. Washington's initial one-cent-per-gallon tax on gasoline and all other liquid fuel except kerosene raised approximately $900,000 per year for the Motor Vehicle Fund.

The 1921 Legislature also required licenses for persons operating motor vehicles. The fee was $1.00, except for children driving automobiles to school, who were charged half the regular fee.