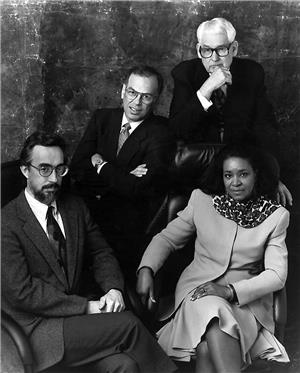

This is an oral history of Aubrey Davis (1917-2013), a member of Group Health Cooperative's Board of Trustees for 38 years, President of the Cooperative for seven terms (1953, 1963, 1964, 1968, 1969, 1984, 1985), Chair of the Cooperative for one term (1986), president and CEO for three years (1988-1991). The interview was conducted by Karen Lynn Maher in Kirkland, Washington, on February 15, 2002.

Maher: How did you become involved with Group Health?

Davis: My wife and I had belonged to Group Health Cooperative in Washington, D.C. before World War II and our first child was born in a hospital in D.C. I remember that she [my wife] was in a ward with twelve people in it. The first day we went in, the baby wasn't ready to come and she went home. We had to come back that night and at that time, there was no bed available in a ward; she was in a hospital bed in a corridor. Our daughter Judy was born successfully. When I came back from the war and we moved to Seattle, we learned there was talk about forming one [a health care cooperative] here. So, we watched it and joined in the second month -- February 1947. Our membership number is 239. The dues at that time were $3 for an adult per month.

We were just members and there were different kinds of meetings that were held by the young organization. The first meetings were held at the Broadway High School at which some of the basic issues were argued about, like whether or not to sign a contract with the medical staff. At the time, we found that the external medical profession did not view us favorably. They would question, "Why are consumers here trying to get involved in this kind of thing [health care]?" They believed health care was only a matter between individual patients and their doctors.

That was the point of view of the old fee-for-service doctors, even though there were already doctors in our community who were experimenting with providing service on a prepaid basis. Dr. Mason, who later founded Virginia Mason, was one of those doctors. For a while, they were some of the leading doctors who were going off to logging camps, mills, and mines signing people up for $1 a month per employee. What they were doing most was treating cuts and bruises, essentially. It was a very early form of prepaid medicine in this frontier area back in the late nineteenth century, early part of the twentieth century. It was a unique part of this country's development. In the twenties, the medical society [King County Medical Society, the local chapter of the American Medical Association] decided that that kind of medical practice was immoral and illegal. Already, they were speaking out against it and organizing against it and ostracizing doctors who practiced that way. Little by little, that sort of died out.

Maher: What died out -- doctors practicing in that prepaid manner?

Davis: Yes, it was discouraged. ... There is a long interesting history behind Group Health, which was viewed very early by organized medicine as a dangerous, bad idea. But, the war was over and here in Seattle a medical group, which had existed primarily to take care of shipyard workers and other non-military employees, had lost all its business because the war ended. What were they going do? Our predecessors (the founders) heard about it and began talking to the medical group and a deal was finally struck that we would buy their medical practice.

Jack Cluck, our attorney, was an important founder. In the beginning, there were about 6,000 people already in the group contract. Group Health did not start offering an individual plan. We were kind of additional business for that group of doctors. They needed to survive. They owned a little hospital and we needed access to a hospital. So, we came together.

Maher: Was that the original St. Luke's Hospital up on Central campus [on Capitol Hill]?

Davis: Yes, the old building. It was merely a run down place, but it was their hospital and our original Board financed that deal by mortgaging their own homes to raise the money to make the down payment. There was a real commitment to make Group Health Cooperative go. There were tensions early on about what it meant to be a co-op and there was resistance to buying a medical practice and having a medical staff that seemed to be in charge of everything. That was all there was -- a medical staff. Originally, one Co-op employee had a desk in the hall of the medical clinic. Rudy Molson, who had been employed by the medical group, became manager of the clinic and a Cooperative employee. Little by little, a co-op structure was formed. But there were idealists who thought it wasn't quite pure enough. The first revolution occurred when a group of them decided to resign and protest.

Maher: Did Cooperative members decide to resign and protest?

Davis: Yes, very early on Co-op members protested. They were unhappy about the direction it (Group Health) was taking in buying the medical plan and giving them (the doctors) too much prominence. I do remember the passion and the heat in those meetings -- the screaming and shouting, the noise and the vigor of debate. It was interesting.

When we started out, we had a group of doctors and a hospital. We were selling individual memberships in the Co-op. I had to pay $100 to join to help provide capital to pay for things like hospitals. People bought their way in and provided their own capital, which is a valid co-op principle. I remember that after we had been going for seven years, our net margin was $7,000. Now that was really non-profit. We redefined the term "non-profit." I was struck by the coincidence of those numbers -- seven years old with a margin of $7,000 in the middle 1950s. Little by little, we agreed that $100 was not a high enough membership fee to buy hospitals and clinics. We raised the fee to $200 and it eventually became clear that it (the $200 fee) wasn't enough. We had to begin making margins. We knew that we had to produce our capital out of our revenue. We tried for a long time to get 5 percent (that was our first target). We didn't get 5 percent very often but we nearly always had a margin of some kind ... . That was a lesson we learned the hard way, and we got better and better at budgeting and watching our competition.

The fact is, the competition between Group Health, King County Medical, and Blue Cross was very much alive then. Blue Cross was basically a hospital-oriented organization and King County Medical was basically doctor-oriented. In this state, they never ever got together as they have in most states. Blue Cross, in most states, includes both. In this state, the two Blue Cross agencies never joined, fortunately. Now, both provide hospital and medical care, but they're competitors. The competition among the three of us has driven down costs in this area compared to national numbers, enormously. It's sort of an accident of history that Seattle has much lower costs than most other urbanized areas.

In 1992, when I was engaged in discussions with a group in Washington, D.C. on a health care reform plan, one of the fellows in the group said, "Aubrey, if we had your costs, we wouldn't have a national health care problem." The fact is, there are only a few cities with strong HMOs or medical plans -- sister plans to Group Health -- Kaiser Permanente in Honolulu and Portland, Group Health Cooperative in Seattle, and what became Health Partners in Minneapolis. All of those four cities have much lower costs -- about 40 percent lower -- than the costs in other big American cities. The competition that we all provided in our communities has driven down the costs compared to other places that didn't have strong HMOs.

Our rulebook from the first was that you should be in the hospital only when you really had to be there. That was a reaction to the Blue Cross plan, which didn't pay benefits unless you were in the hospital. So, what happened was doctors had to put people in the hospital in order to have services covered, which is clearly an inefficient idea. We were a reaction to that way of operating. We would cover medical costs for people who were in the hospital and for those who were not in the hospital, but we wanted to minimize unnecessary hospitalizations. So, our hospital days per thousand enrollees was always much lower than the city's because of that historical fact. That's how we kept our costs down. Now other people [our competitors] have learned that, so we've lost that competitive edge we had for a long time.

Other interesting meetings were district meetings. I remember attending one at a union hall in the Rainier Valley, where we lived at that time. There was a Rainier Valley food cooperative, which had a very active leadership group -- some very interesting characters -- and they were also the core of the Group Health membership there. We had membership meetings of 30, 40, 50 people. I was puzzled because here we had a Board we elected, and at those meetings the reports were always given by the Group Health manager, Don Northrup, and not by the Board of Trustees member present at the meeting.

Maher: Who was the board member?

Davis: The Board member was Bob Wells who was a member of the Rainier Valley food co-op. He sat in the audience while Don Northrup explained what the Board was doing, what it was talking about and what it was worried about. It seemed to me that Bob Wells ought to be giving the report. So, when Bob said he didn't want to serve as a trustee any longer, I decided to run for his Board position because I thought that reporting to the members should be changed.

Maher: What year did you run for the Board?

Davis: That was 1951. I had been on a committee or two, including a bylaw committee at one point, so I had a little more interest than just being a member. I was elected and then served for 21 years -- seven terms. I went off the Board in 1972. I attended my district meeting every quarter for that 21 years except once when I was out of town.

After I joined the Board, some trustees -- including me --began to be uncomfortable with the quality of our management. We thought that our budgeting and purchasing processes were not very good.

Maher: At what point in time was your dissatisfaction?

Davis: That would have been about 1954 or 1955, something like that. We commissioned studies by Co-op members who had professional experience in these fields and made reports to the Board on budgeting and purchasing. We decided that we ought to make a change in management. It occurred to me that we faced a tough challenge because the doctors had supported our managers and the doctors would clearly be uncomfortable with any change. So, I organized a committee of members in my district and met with them for quite a few months to keep them up-to-date on what was happening.

The rule we adopted was that both husband and wife were members of these committees and both could attend meetings. We met in members' homes, sometimes in the Holly Park or Rainier Vista housing projects and sometimes in other places in the area. So, when the time came when we had the big explosion, I had a constituency that knew what was going on and supported me. That was the beginning of the District Executive Committee meetings, which later became MCCs [Medical Center Councils]. That was the beginning of the core group of half a dozen people plus spouses who went through a lot of turmoil. I took reports to them, as the reports were available. We talked about the information and identified changes we wanted to make and how to make those changes happen. Finally, the board voted four to three to replace the manager.

Maher: Were you the Chair of the Cooperative at the time? Actually, what was the title of the highest-ranking consumer position at that time?

Davis: The title was president. [Ed. note: Paul Goodin was president; David was vice president.]

Davis: The medical staff was furious. There was a special meeting called and the medical staff called for recalling the Board. We had a real war, but finally settled by a compromise. We hired Sandy MacColl to be interim executive director. Sandy was a medical staff leader but not an official officer of the medical staff, so we had both sides together.

Maher: So that's how Dr. MacColl got into the executive responsibilities of the Cooperative.

Davis: That's right. We brought in a guy who was trained as a hospital administrator, who was to be the manager under Sandy MacColl. That relationship didn't work too well. but it did bring peace for a while.

There was another big fight at that time between the Board and the medical staff, which was perhaps even more serious. The medical staff had a doctor who was not very collaborative with them and they thought they should let him go. His name was Dr. Alan Sachs, Bea Sachs's husband, and he was the only board-certified surgeon we had. The surgeon that was going to replace him was not board certified. We insisted that they go through a different kind of a process to make the decision and they rebelled. That conflict almost broke up the organization.

Maher: When you say "they" do you mean the medical staff?

Davis: Yes, the medical staff said that the Board had no role in the decision. The Board was angry that the medical staff had not followed proper procedures in firing the only board-certified surgeon in the Cooperative.

Maher: What was the date of this conflict?

Davis: That was about '54 or so; it was in those early days. That conflict led to the creation of the Joint Conference Committee. We (the Board) brought in experts from other places in the country to advise us about how to deal with this (our relationship with the medical staff). It was recommended that we pay more attention to quality and stop taking their (the medical staff's) word for it.

Maher: What is the purpose of the Joint Conference Committee?

Davis: The rule was anything either side wanted to talk about was germane. Anything they wanted to complain about or talk about to us, and vice versa, was discussed in Joint Conference. ... the Board and the medical staff.

It turned out that the Joint Conference Committee was an institution in other hospitals; we were advised that was one way to go. We had one doctor who came and surveyed us and said our quality wasn't very good in some places. The medical staff didn't like that and questioned what to do about it. We had trouble hiring, although the doctors we started out with were all well educated and were respected in the community. But, they were still "sinning" by working with Group Health and not in a private fee-for-service practice, which was the "God-given" way it should be.

Maher: Why did doctors at that time work for Group Health? What was the attraction?

Davis: The first doctors had belonged to the original group practice (that was purchased by the founders). So, they were interested in group practice, as we were. We thought that was the best thing to have.

The attractions were such things as predictable hours (i.e. one doctor would be available for the weekend for the whole group instead of everybody being on-call). They had more definable hours and we were committed to a retirement plan, which we didn't fund very well for a long time but the concept was there. They had regular salaries -- predictable income. They didn't have to worry about collections and going after patients to get paid. They could let the business be done by somebody else. They could just practice medicine. There were doctors who thought that was the way they wanted to go, even though the medical community considered them pariahs. Actually, some thought that it was actually immoral (to be associated with Group Health). So, to attract good doctors, we had to keep reasserting that our doctors were independent.

We had a contract with the medical group that gave them a great deal of authority to operate themselves. We spent a lot of our early years working out the relationship with our doctors. I remember meetings going all the way past midnight lots of times -- long negotiations and long arguments. They (physicians) were relying on us. We (the Cooperative as a whole) had to succeed for them to have a job and they knew that. But we had to be willing to keep them, or we didn't have doctors.

As we grew, we had to be able to get new doctors. We only wanted good doctors, so we had to get doctors who had choices. Our message was "You're an independent doctor. We don't tell you how to practice medicine. You're not our employee." Technically, they were [employees], but we learned very early that it did not profit us at all to make that point because that cut off the basic cultural thing that was necessary for their existence. They had to have that professional independence or the relationship didn't work, as we learned later by watching the troubles of Group Health in Washington, D.C. That organization thought their doctors had to be employees, which didn't work and they finally crashed and burned. So, we have spent 50 years learning how to build the relationship between an elected governing board and the medical staff.

Most non-profit boards are "owned" by somebody who is in charge and selects the board of directors. Typically, the CEO/president/top manager goes around and picks people to be on "his/her" board. That's a known institution; if you know the leader then you know the board. That is the kind of board we have seen all over the country. We have seen another example of it recently in the Blue Cross board. That company almost collapsed because the board was owned by the CEO, who was making some bad choices. Blue Cross lost $50 million in one year and almost died. We watched our major bank be bought by a California bank because its officers and board didn't do their duty in overseeing management. They made a bunch of bad investments and the bank crashed and burned. Say what you will about our [Group Health's] Board being amateurs and civilians instead of professionals, but somehow we've managed through the years to keep this organization growing and surviving. We weren't owned by anybody except our membership -- a very strange idea.

Maher: .... Why does consumer involvement matter?

Davis: Well, it goes to the heart of the organization. What kind of organization is it? I'm chairman of two businesses and in both businesses the board hires a CEO, but the CEO pretty well runs things and we let him. We expect him to. He tells us what he's going to do and we ask questions and make suggestions. We represent the shareholders. One is a family company so our family is involved. The other is a broader company. As long as the company is successful, the board lets it pretty well function. It's kind of a partnership between the board and the managers, but the managers are really in charge. The managers are the one who tend to decide what board members there are.

We [Group Health] are different. Our management doesn't select our Board. The membership does, or at least the core leadership in the membership does -- quite a few thousand people, not anything like a majority of the members. If they're interested, anybody can participate. It makes a lot of difference in the long term. It means that when the managers are dealing with a difficult issue, they always know that they're going to be asked questions by this person or that person [Board members] and they do not want to be embarrassed.

We were having one of our big annual meetings when we were dealing with the abortion issue back in the '80s. The meeting was so big that we had to go to the Tacoma Dome to find a place big enough. Twenty-five hundred people came. I kidded Gail Warden, our CEO, "You know Gail, if this were an ordinary board, the meeting would be over. It would've lasted a few minutes and you would run and play golf for the rest of the afternoon." We were there to argue about a basic fundamental issue -- whether or not to cover abortions, a very tough issue in our society. We decided by the membership voting on it. It took a while to go through the argument. No one sat down in a small room and said, "This is how we're going to do it, folks, and that is it."

Management behaves a lot differently when big decisions are made by members or by Board members. It makes some things go slower, but most of the slowness is management preparing itself so it doesn't become foolish or do something that can't be explained to other people.

Consumer involvement also means other kinds of differences. We started out in the very beginning covering the cost of prescription drugs in our plan. The experts said, "That won't work; people will rob you blind. They will get prescriptions they don't need and waste them." I remember meeting with a union group in St. Louis once and explaining what our drug policy was and how we did it. One person said, "That is so obviously wrong that you must be misinformed." I should have been affronted I guess, but I thought it was so amusing that he was so sure that it wouldn't work and that I was either lying or didn't know any better. I explained our structure, membership numbers, and cost per month; he didn't believe me. I explained that patients get a prescription only if a doctor orders one and generally the doctor only orders what he thinks is necessary. That was long before we had all this advertising pushing people to buy things that they don't even know about.

Our doctors decide which drugs they think are useful and safe and that is what they prescribe. We buy collectively; we are becoming the largest purchaser of drugs in the state. We buy them by the barrel and put them in little bottles. It's a very efficient way of doing it. It's interesting to me that people outside say that it (our way) can't be successful.

Now that (covering the cost of prescriptions) happened because the membership thought it was important and the Board listened. Our contract is that the Board decides economic issues, like what our plan covers and the services provided. The doctors select their physician colleagues and make medical decisions. Sometimes, the doctors would tell us we shouldn't be providing drugs; we should make people go out and buy them. There was never a big push, but there are individuals who say, "That doesn't make any sense; that doesn't work in this world." Covering prescriptions was one of the results of our being a membership-focused organization. I don't know if it we would have been successful otherwise.

Maher: So, consumer involvement matters because it makes for a better organization.

Davis: It makes for an organization with policies focused on the interest of the user and not just the interest of the people providing the service. There's always a balance there because you've got to keep your providers happy enough to stay and be comfortable in their working relationships, but you also want consumers to get what they need. A lot of things happened in our organization as a result of that balance.

Now, when we went into mental health, it was members pushing for it with doctors saying we can't afford it. Bea Sachs had been with them [the medical staff] for a long time and was doing some of that [providing mental health care], which was all right. She was an internist, not a psychiatrist, but it took quite a while before they would hire a psychiatrist. They did finally; because even they didn't think mental health care was a necessary part of medical care, especially since the Cooperative was marginal economically. There was push back by the medical staff. There have been a number of issues where that kind of debate came up.

Maher: Do you feel that consumer involvement leads to better decisions?

Davis: They are better decisions in terms of meeting the interests of our members. Most successful companies try to serve their customers effectively. What we have is a more efficient way of knowing what customers want and need. We do surveys like other companies, but we are also in touch with the people who are experiencing our service. They are the ones who are dealing with management and doctors on a daily basis.

Maher: There's a conversation going on.

Davis: That's right. Now, obviously it works both ways. The doctors are constantly looking at changes in practice that they desire. Fortunately, they're usually relatively conservative; they don't pick up the new things quickly, which means that they are reluctant to go to things that aren't proven. The medical staff has spared us some pretty bad times. There have been fads that have swept through the medical community that we missed because our doctors said, "We don't believe in that." They were right. So this is not any one-way street.

What we've developed here is a very unique -- I think it's unfortunate how unique it is -- relationship between medical staff and the organization. The big change that has happened over the years is that we have developed a more and more professional management. We start out with one or two physicians and now how many are there ... hundreds? Our medical staff has all kinds of skills and subsets of skills. I think what is really unique about Group Health is a relationship that does not exist in any other organization. .... The relationship between the providers and the users. That relationship is unique to Group Health Cooperative.

Our mission has been to make that relationship work. It is a strain on both sides. Professionals are not used to having non-professionals tell them what to do and customers are not used to being told what they can and can't get. So, both sides have to temper their behavior to make it work. We've been lucky over the years. We've had some broad-minded, very successful people who have been on the Board. We've had some doctors who really believed the relationship had to work who worked hard at making it work on their other side. There have been times when things got kind of scary when the relationship broke down but it is the unique thing about Group Health.

We're different from Kaiser in that respect. Kaiser has developed a relationship between management and professionals that is different, but they don't have consumer input at that point. There are very few organizations that parallel what we have -- a successful working relationship among members, management, and the medical staff.

Maher: When you think of your own personal experience with Group Health governance, what's been your most significant experience?

Davis: I don't know how to answer that question. I am really proud of having had some founding ideas about how to organize consumers to participate at the local level. They were ideas I thought of accidentally. Sometimes, good ideas are accidental. I think that was a relatively important one.

I have thought that our focus on making the relationship among members, management, and the medical staff work has been an important thing for us. I have worked hard at that all during the years. I was chairman of the Joint Conference Committee for a long time when I wasn't chair of the Board. We had wonderful people -- Hilde Birnbaum and Chuck Strother to name two outstanding people -- who played key roles in shaping this organization. They all understood the importance of our basic cultural difference. We've been surviving as a success partly because we're able to strike the balance between the principles of our system and the economics of it.

Maher: You lead me to another question. There have been many periods in Group Health's history where they've had difficult years. The past five years have been very hard. What is the source of Group Health's ability to weather the difficult times?

Davis: This last one we weathered because we -- all of us in leadership -- had the sense to recognize in the early '90s that it was going to be hard later. Knowing that, we piled up some reserves. We knew that the health care reform we thought was coming was going to lead to a certain kind of competition, which would be rough. We needed to store chestnuts for that time. I knew it. Phil Nudelman knew it. Cheryl Scott knew it. We were able to gather the reserves and weather the storm. It was rougher than we thought it was going to be and lasted longer, but we had a pretty substantial net asset when we started out and dug into that. We couldn't keep on losing money, though, and we turned it around.

When I became CEO, one of the things that seemed to me ought to be made clear was that we have to plan to make money; we just can't let it be what's left at the end of the year. We had to structure ourselves to make sure it happened, not just hope it would happen. We had to produce a margin -- what we call our profit -- because we don't have other sources of capital. X-ray equipment bought in 1980 costs a lot more to replace in 1990, so the depreciation would be enough to replace it. If we didn't have a margin, we would have no way of updating our equipment and our plant, much less build clinics and stuff like that. We had to produce a margin so we had to budget it and make it happen, not budget it and hope it would happen. We had to make it a claim on our revenues. A lot of folks didn't understand that approach.

Maher: Is that kind of financial planning one of your significant contributions?

Davis: Well, I'm not alone on this but I certainly was one who pushed it and articulated it. I wanted to make it [financial planning] more centered than it had been.

Maher: You became CEO when Gail Warden left Group Health. What year was it?

Davis: I became CEO in February of 1988 [with a tenure of three years].

Maher: When you left, Phil Nudelman was hired as CEO.

Davis: Yes, I didn't know how long I wanted to stay as CEO so I only signed a year-by-year contract.

It really was time to make a permanent change and I didn't want to keep on doing the job indefinitely. We did a national search and decided quite properly to hire Phil, although it was not at all clear in the beginning how it was going to come out. We didn't know what kind of people might be available to us. After we did see who was available, we interviewed the most likely candidates. We made the right decision that Phil was the person we should hire. It was time to get ready for more changes and Phil was the one to make that happen.

I had an understanding with the Board that I would stay on in a much narrower role concerned only with health care policy and my contract said explicitly that I would not be involved in administration.

Maher: This was when Phil was hired and you became "President Emeritus"?

Davis: Yes. That was worked out before we began the CEO search; everybody knew that. It was thought by some to be a potential problem, but it didn't turn out to be. I made it very clear that I knew how to leave the job (as CEO). People sometimes came to me and said, "Gee, this has gone wrong. You need to ..." I responded, "No, I don't, it is not my job." If I started doing that, I could not have stayed because you can't have two people in charge. I encouraged people to deal directly with Phil.

--Break in the Interview--

Davis: I want to talk some more about the membership.

Maher: Go!

Davis: As I look back, I think there have been quite a few times when the membership has made a major difference.

I remember in the '50s and '60s, several times the Board considered, "Should we start charging people for things or should we keep dues covering everything?" At that time, we were pretty much community-rated and we were covering a relatively comprehensive set of things all within the dues/premium structure. We kept testing that idea partly in our district meetings and partly through surveys. The membership was decisive two or three times. What struck me was it was almost an immutable law because the vote was always about the same percentage -- about 77 percent, I think -- of members saying, "Raise the dues; don't start nickel and diming us for things." We asked again several years later and got the same response, several thousand people responded and got the same percentage breakdown. Our membership was very cohesive on its sense of what we should be doing about that [comprehensive coverage].

The big decision on covering abortions I mentioned earlier was done in a way which really reflected the values of our membership. It was such a big deal that it was being talked of by membership groups. The national press covered it. The New York Times and a national TV station were there because it was unique for an organization to be talking about that kind of subject as a public issue to be voted on. I was really proud of our membership then. Not only do I think the membership did the right thing, but the process was appropriate. We structured very carefully the way those meetings were operated. We kept the people with signs -- which were a lot of them -- outside. The people were welcome, but they could not bring in their signs. We didn't want sticks becoming weapons and so forth. We organized the meeting well. The discussion was orderly with no name-calling or bad rhetoric, which occurs sometimes in those kinds of discussion. The arguments were made and a vote was taken, which was decisive. I think it was 3:1, maybe 2:1, but it was decisive to cover abortion services. It got revisited a year later with a little different twist.

Historically, members felt differently about Group Health than they would about Aetna, New York Life, Cigna or some other insurance plan. I don't know how long this will last. But, members feel that Group Health is theirs. It's important to them and they need to protect it and act responsibly toward it, which is what surprises people. We do not get bled by people abusing our delivery system. That was very strong in the early years. I remember being at meetings talking about how to deal with the budget. People got up and said, "We have to charge more? We'll pay more, tell us what it is." The membership has been very responsible and has pretty well followed its leaders' recommendations on critical issues. The whole system has worked.

The membership has been asked to participate in important decisions quite a few times. When we thought we were going to need the relationship with Kaiser-Permanente, we held lots and lots of meetings with the membership and then had a big vote. There were uncertainties in question but the Board thought it knew where it was going and where it should go and the membership agreed. It didn't work out the way we thought it was going to work out and we backed out of some parts of the plan. The vision Phil Nudelman and David Lawrence [Kaiser CEO] had turned out to be somewhat different from how the organizations were actually working at a managerial level. Things didn't come out the way we thought they would come out. We drifted apart somewhat. Both organizations decided not to go forward. Partly, both came on bad times. They were losing scads of money. We were losing more money than we could afford to keep losing. We didn't want to be a colony; they didn't want to be a colonizer, but it sort of felt that way. We drifted away from the first ideas.

Maher: But, initially the membership supported the idea and the vision to move toward developing a partnership.

Davis: That's right. They supported it after very thoughtful discussion and very thoughtful voting. They ratified what we proposed and it didn't work out ... We backed out to some extent. I think a lot of folks have been surprised about how smart the membership seems to be on these critical issues. There have been some wild folks from time to time but they never have captured the membership's imagination or control. They rise up like a hot spot in Yellowstone -- the steam comes up, but doesn't become Old Faithful. The issue just dies back down again. I won't mention any names but I can think of people through the years who've played roles or tried to make some change they thought was critical and most of the Board didn't agree and the membership stayed with the Board every time that happened.

We've been lucky in our leadership and lucky that we had some ideas from the first that were valid. Being able to find a balance is critical -- the balance between our founding idealism and economic necessities. In the '80s, we had to finally recognize that we couldn't keep on loading everything into the premium costs because we were being eaten alive by our competition's lower premiums. We had to recognize that we had to adjust premiums in terms of age. Our rates were too high for young people who could get them cheaper elsewhere, and we were such a good buy for older people that we got more than our share. We had to accommodate the marketplace, which is true of any business. Hilde Birnbaum always led the way by saying, "We have to succeed as a business if we are going to survive as a cooperative." We managed to do that but we've done it with membership support.

Maher: Was there a turning point when the membership understood that concept?

Davis: A turning point. (Pause) I don't think the membership necessarily understood the concept, but the membership produced leaders who understood it and they [the members] were willing to rely on the leaders. That's what's happened. What members have done is be satisfied enough with their health care and let their elected leaders do what they thought was best. Members accepted and followed the leaders. That is really what's happened. Nobody understands all this stuff; it's not possible unless you focus on it for a long time. That's been our good luck and our success.

Maher: As you are aware, Cheryl Scott has led an effort to create a new purpose and vision for Group Health. That purpose is to transform health care. How do you see that the Cooperative is actively transforming health care?

Davis: I had the pleasure Wednesday night this week of making the motion and introducing the new business plan. I pointed out to the Board that our aspirations are the right ones for a cooperative to have. They are aspirations in terms of satisfying and providing the best possible service to our people. When I talked about specifics, the focus was on becoming seen as trustworthy by our members -- patients -- and being seen as the best place to get health care. The focus is on the right things for our culture and our organization, with a very special focus on the way in which our members experience their visit -- the way it looks, the way it feels, the way they are treated. We have to succeed in improving our members' experience, which currently is not bad. It just needs to be better. That's the focus of the business plan.

We're trying not only to produce quality health care, but to do it in a way people accept and feel good about. Here is one of the unique things we do at Group Health in that direction. Annually, as a retired federal employee, I get a booklet on health plan choices and that booklet has begun to provide information about what the quality of services are for various plans. Group Health reports its numbers on service quality. There is not a single competitor in this area that can do that because data is not available, mainly because they don't collect it. Apparently, they not do know their results; they just don't track the data.

Quarterly, we publish in our employee newsletters the results of our quality goals. No one else has the guts to do that. We expect to have a certain number of immunizations or accomplish certain things in diabetic or heart care. We have goals related to quality of care. We don't always reach those goals, but we say so. It is a brave thing for an organization to indicate that it is striving and is not perfect. We're trying to improve these things and we are partly succeeding. To report that to employees and to the membership would be scary for most people. Usually those things get covered up, not shared. Sharing our results is unique to Group Health. It is part of our basic orientation of who we are and what we are about. So, this transformation that you referred to is trying to improve our accountability to our members, including improving the satisfaction of our members and working on the right things to make that happen. It is more and more a focused effort in that direction. I feel very good about it and was very happy to go through some of those details with the Board the other night.

I just didn't make the motion and say, "We ought to approve this ... here it is folks." I went in and said, "Here is what it [he business plan] says. If you haven't read the whole thing, at least read the summary -- pages 1-10." It's a document that is 50 pages or so. I did not know if everybody read the whole thing, but at least there were things in there that needed to be recognized. I told the Board, "One of our most important things we do is approve this plan. It's been worked on for some time in several committees and it is important for us to remember that this is what we're about."

Then we tie the business plan to the internal motivation and the contracts our managers have. They're supposed to make certain goals. Part of their pay depends upon whether they make those goals or not. They all build as part of this structure of accountability. Those are good ideas and those will transform. They are working on the right things. It is kind of gutsy and unique that we are so public about it. I doubt you can find many organizations that have the nerve to report to their employees and potentially to their users and/or members how well they are meeting their goals. Enron lied. They made it [their company] look good when it wasn't. It is gutsy to do the other thing -- to report how you are doing when you are not fully succeeding in meeting every goal.

Maher: What is Group Health's greatest strength?

Davis: First, its culture and the balance between meeting the interests of its professionals and the interests of its users. Second, recognizing the economic factor in that balance blended with the organization's ideological and philosophical morals. Third, valuing and trusting the membership's involvement/guidance when facing crucial issues. Fourth, changing and improving medical practice, which is becoming more and more scientific. What are Group Health's greatest strengths? All we endorse, subscribe to, and are accomplishing.

Maher: How has Group Health changed the community?

Davis: I said something about that a little earlier. The competition that we provided here lowered health care costs in this area compared with most major American cities dramatically -- not just marginally. But, we have been penalized for that. The way Medicare works [reimburses for health care services] hurts us instead of helping us. One of the things that's wrong with the national health plans that have been proposed is they are unresponsive to such things as the difference in costs across the country. We don't really know how to deal with that. So, Group Health has initiated managing hospital care very carefully and trying to provide the health care people need instead of what they may ask for. It has become a much wider practice. Other plans have had to follow us in order to stay afloat. Our competitors try to do the same thing. They don't have any direct consumer input in what they're doing. They are managed by boards, which are pretty much creatures of the current manager in charge. We're fundamentally different. The results of our plan have changed the way health care is practiced here. It has saved millions, maybe billions, of dollars.

I remember an interesting conversation I had with Dr. Sim Rubenstein. He was talking to a guy who had been head of the Washington Medical Association. He said, "Sim, all I really want is what your doctors have." Now that is a 180 degree change from where we started. In the beginning, what Group Health doctors had was the last thing private, fee-for-service doctors wanted. Now, they want to be able to practice medicine and let someone else worry about how the bills are paid. That story shows another change we have made.

Maher: When you're talking to people out in the world, how do you describe Group Health?

Davis: I say, "Group Health is a place that succeeds because it takes care of its patients. It provides them with what they really need, not necessarily what they want, and it does so by keeping current on science and medicine. Group Health does this by knowing how to balance economics with its founding principles." That's what it is. There are a lot of illusions about it, especially about choosing a doctor. People have a lot of choice of doctors, but they don't know that. You can change doctors, if you want.

Maher: What's been the barrier for people's lack of understanding that they have choice at Group Health?

Davis: Well, for one thing, our competitors keep saying that people don't have choice. Their sales pitch is that they offer choice and Group Health doesn't. People hear a lot that Group Health doesn't have choice. Then, there are a certain number of people who think that the higher paid doctors in private practice -- the real expensive ones -- must be better. How else do they make more money? People have that illusion.

I believe that our doctors are as good and better than most. I'm not sure they're as good at TLC [tender loving care] as doctors in private practice, which is unfortunate. One of the things we're talking about in our current business plan is improving that relationship -- the feelings patients have about their doctor. It means our doctors and nurses will have to sharpen up their behavior to improve that. But, in terms of end product, our quality of care is actually better than the community average.

Maher: When I say "Group Health," what immediately comes to mind?

Davis: Oh, I think of this institution and its various parts, which mix well together and are working fundamentally for the interests of 500,000 people who use its services. Also, I think of how Group Health has played a misunderstood role in changing the way medical care is delivered in this area.

Maher: What is the single greatest challenge Group Health faces in the next five years?

Davis: The same one it has always faced -- making this thing work. It's not written in the tablets that it will work. No one guarantees it will be here in five years, 10 years or 50 years. It all depends on our luck and our leadership. There are powerful, powerful things outside that are dangerous for us, particularly as the government gets more and more concerned about its budget and how much health care costs and its effort to tame that [rising costs]. It's a real push back on organizations like us to do with less and less while the demands increase. That is beginning to be more and more true. The national government, in balancing its budget, is deciding it wants to spend less on Medicare than it otherwise was going to spend. Here, we're already a "best buy" to them because they spend $500 a month for a senior here, instead of the $800 or $900 they spend in many other places. We get no credit for that. I remember desperate times, when I was CEO, when New York would get 12 percent reimbursement and we got 2 or 3 percent. It is crazy.

Maher: Is that a result of Group Health costing less?

Davis: Yes, far less, which means we had less resources to work with. In places that receive a higher reimbursement, it meant that HMOs could go in there and give away things because they would get so much revenue from the government. No premium, zero premiums in areas where the costs are high. They should diminish those a little bit, which they could do, where they could make money and charge no premium at all. Now, here, we just barely get money for what our costs are because we brought our costs down. Other places get hundreds and hundreds of dollars more than we get.

Maher: And you're referring to the government reimbursement?

Davis: That's right, and about half of our business is government business. We've been through the same thing with HealthyOptions, our Medicaid program. The basic health plans have that problem and the public employee groups also face the issue of driving down their costs to match how much they are being paid. So, our biggest threat is the inability of the government and private people to pay what it costs. The government lowered its reimbursement and basically said, "You can either live with it or get out." Many health plans are getting out of government business. We're too deeply into it to do that, although we have gotten out in some places where we simply could not afford to remain. We've gotten out of some counties where we couldn't get the cost that we had to pay down far enough to match the revenue we were paid. So, we had to leave. We left Eastern Washington and Medicare, for instance, on a prepaid basis. We still do some fee-for-service. That is going to be a rising problem for us.

Maher: Are there other trends in health care to which Group Health should pay special attention?

Davis: Well, we have to do a better job of countering the choice issue. We are approaching that more seriously in our current business plans.

Maher: And by the "choice issue" do you mean the perception that people have limited choice in physician selection?

Davis: Yes. What we have found is we have a higher degree of loyalty from people who stay with us than most plans. But with companies coming and going, most of our turnover is out of our control and is not based on individual choices.

Our record of people leaving voluntarily, deciding they need to leave for whatever reason, is very good -- about 3-5 percent, which is very low. Our turnover is much higher than that because of the offering issue. Companies decide they can buy cheaper health care and more choice -- they think -- someplace else, so they don't offer us. We have to have very competitive prices to fight that and we have to do an even better job of making people so satisfied that they insist on Group Health being offered. That happens now but we need more of that. So, those threats are out there for us.

We have a capital problem because we don't have any way of generating capital except out of our business. Our present competitors in this state, two big ones -- Premera, which used to be Blue Cross, and Regence, which used to be King County Medical, are non-profit and depend on their margins also. Outsiders coming in have capital resources we don't have.

Maher: Why should a young family join Group Health Cooperative?

Davis: Well, it is a great place for health care for kids. It is possible to establish a family relationship that will guide them for a long time, just like in the old days. I've only had three or four personal physicians in all my 50 years at Group Health. That has been very important to me. Where else could you wake up in an ICU some morning -- having been there for some heart disturbance -- and a cardiologist looks at you and says, "Here's what we ought to do" and then your family doctor comes by and says, "No, I know this patient and he doesn't need that." Where else would a family doctor tell a cardiologist what not to do? Nowhere.

My son-in-law was a minister in Houston and had a church member who was the commander of a space shuttle. He invited my son-in-law to come to Florida as the chaplain who met with the crew before take off. He was allowed to bring some family along so my wife and I went too and watched the space shuttle take off. Well, I got sick and called our consulting nurse and asked for a prescription, which I had to have checked to make sure it was consistent with other things I was taking, and to have it faxed to an all-night pharmacy located a mile away. Where else could you do that? They did everything I asked. They talked to a pharmacist on duty and verified that what I thought I should get was compatible with other drugs I was taking. They faxed the prescription and I was able to go down there at two o'clock in the morning to pick it up. Our pharmacy system and our consulting nurse service all worked to deal with me -- a patient who was 3,000 miles away. At midnight they could look up the records and see what was appropriate. Where else?

Maher: What has been your most significant health care experience at Group Health?

Davis: Well, I have just had one. Last fall, I began to have shortness of breath and started feeling loss of energy. I called my family doctor, he said, "Come in today." He did not say, "Come in three weeks from now." He might have said, "It's asthma; use your inhaler for it," but he did not say that. He took an x-ray and found a very small amount of fluid in my lungs and decided I had a heart weakness and referred me to a cardiologist. They did an angiogram and found that there were three arteries in my heart that were substantially plugged. I had not had a heart attack, but I could have.

Our cardiologists and the Virginia Mason cardiologists meet every Tuesday to determine the best treatment for patients. They came to me and said, "We can either do a triple bypass or angioplasty." I asked the doctor, "Tell me about these and what are the risks?" My cardiologist said, "Well, triple bypass at your age has about a 5 percent chance of serious consequence -- death or stroke. The angioplasty has less than 1 percent risk." I said, "Well, that makes it easy, doesn't it? I'll take the odds. Do the angioplasty." Two weeks later, my cardiologist broke his shoulder so he wasn't able to do the work. He turned me over to a fellow cardiologist and he did two stints at Virginia Mason. In a week or so, I was hearty again. They didn't have time to do the third one so we just did that Tuesday this week [3 days earlier]. I came home Wednesday morning. When I went in, I said, "All I really want is another 10 or 15 years, that's all." Very modest; I'm 84 years old so I didn't want to push my luck. The cardiologist said, "Well, I think we got 20 for you." So, they dealt with the problem without my having had a heart attack. The system worked.

My wife had both hips replaced in 1989 and recently one of them wore out and she was having trouble walking comfortably. So, she was scheduled to have the hip replacement in December. I wanted her to get back on her feet before I went back in for the second angioplasty. Otherwise, they would have done my work earlier. She couldn't come upstairs; she had to be downstairs full time when she came home from the hospital. The kids bought a refrigerator and a microwave for the basement; I didn't think she was ever going to come upstairs. I did most of the cooking. A granddaughter who was staying here did some. I did the laundry and the shopping and it all got delivered to her down there. She had the New York Times crossword puzzle to work on and a big easy chair to relax in.

Maher: She was happy.

Davis: Yes, what could be wrong with that? She had a walker and she could go to the TV or go to the computer. Otherwise, everything was brought to her. It was a very successful operation.

Maher: When you think about your history with Group Health, what has been your most significant contribution to the Cooperative?

Davis: I think my efforts to refine, preserve, and make this culture work. I think that's really what is most important. The special, unique relationships our consumers have with our medical staff and with our managers. That's what is important to me. That's what I tried to make work. Largely it has, so I feel good about that.

Maher: What has been the Cooperative's most significant contribution to you?

Davis: I am 84 years old. I have gotten superb health care. I appreciate the more recent examples I just talked about.

Maher: How does Group Health's past prepare it to meet the challenges of the present and the future?

Davis: That is always pretty tricky. It's possible for your past to become an anchor instead of a propellant. Success depends upon knowing what you can save and what you should not save. We've been able to, so far, sacrifice what had to go while preserving what we thought had to be saved. Whether we'll be able to keep doing that depends on who is doing it and what happens in the general field of health care, which is a real mess. We have turned health care over to the insurance system, which supposedly has the idea of sharing/spreading risk. What really happens is it becomes a way of just managing money.

Maher: Who do you mean when you say "we?"

Davis: Society. Society has turned it [health care] over. If we're going to have the insurance system be the payer, we have to strike a different bargain with that industry. That bargain would sound something like, "Okay, you can be the payer, but you have to accept and manage risk instead of spending your time avoiding it." We have to cover everybody and we have to use broad principles like community rating and really spread the risk around. There are easy ways of doing that, which are unique to the insurance industry. However, the industry wants to "select" risk instead of managing it. And that's been our fundamental problem from the first; the insurance industry wants to select risk -- avoid bad risk -- instead of spreading the risk by managing it. That fundamental issue has never been resolved. So it is, we are in a mess.

Maher: What would it take to resolve it?

Davis: Last fall when I made this statement to a committee of the legislature, someone said, "When are you going to run for governor?" I'm not going to do that. It would take leadership calling the insurance industry to task and saying, "Look guys, this isn't working. Our public is not being served by the way it's working. It's not all your fault, but we've got to change the way we're doing things or else we'll take it away from the insurance system." I haven't seen any leader willing to do that. The President (George W. Bush) could do it. Bill Clinton approached it in a very awkward way, which set us all back. [Governor] Mike Lowry got started down that road. So did [Governor] Booth Gardner to some extent. We [Group Health] got started but it all tumbled, partly because of national failures. Our present governor [Gary Locke] has not found it a priority. Anyway, it would really be hard to do in one state.

Some steps could be taken. It isn't a way of making insurance companies lose money; it's a way of making them manage themselves differently by spreading the risk through the insurance system. This idea has been brought to them. I've done it and so have others. They're not interested; they don't see that as the way they want to function. They're not comfortable. They've lived all their lives dealing with avoiding risk and managing the money. They use money as an investment base to make money on their investment. They use the health care system as a way of getting money they can use to invest and make money instead of paying for health care. The result is we have a major mess. Here, the most prosperous and successful society that ever lived can't deal with this issue. It is a shame. It is an affront.

Maher: What's your greatest hope for Group Health?

Davis: Even with all these pressures, that we will be able to become the favored plan, the best plan, the best service. We have the right aspirations, I think, and we're struggling to make them happen. And that's what life is about -- the struggle.