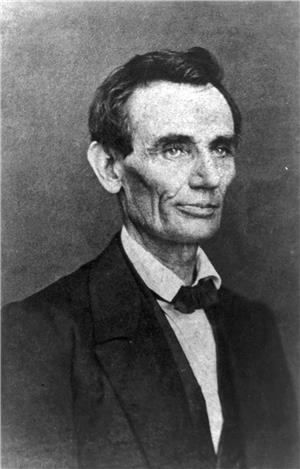

On August 5, 1861, President Abraham Lincoln (1809-1865) signs the Revenue Act of 1861, passed by the U.S. Congress "to provide increased Revenue from Imports, to pay Interest on the Public Debt, and for other Purposes" (Public Acts, 292). Among the stipulations of the new law that will affect Washington Territory are a direct tax of $20 million in property taxes, as well as the first income tax ever levied by the federal government.

A National Emergency

A month earlier, on July 4, President Lincoln had opened a special session of Congress, called to deal with the national emergency occasioned by the outbreak of the Civil War. One of the most pressing issues facing the legislators was raising the necessary funds to meet the extraordinary expenditures of the war effort. In his opening address to the joint body, Lincoln spoke of the outpouring of volunteers willing to serve in the Union forces, but noted that "one of the greatest perplexities of the government, is to avoid receiving troops faster than it can provide for them. In a word, the people will save their government, if the government itself, will do its part" (Lincoln, 3228).

To raise approximately $50 million in increased revenue, the legislators decided to increase tariffs on certain imports and to institute a tax on real estate, to be levied in proportion to each state's population. The bureaucracy of tax assessors and collectors required to administer this new tax raised the ire of several representatives, as did the fact that real estate was to be taxed while other forms of property were excluded, thereby putting a heavy burden on the sparsely populated states and territories of the West and Southwest and on farmers. Because the newly elected delegate from Washington Territory, William H. Wallace (1811-1879), had not yet arrived in the capital, no one spoke directly for the interests of the territory, but one representative of a rural state asked

"if the farmers of this country are to have their lands pledged as security for payment of this debt, while the great stockholders, the money lenders, and the merchant princes of Wall Street, and all the great capitalists, are to go free, and bear none of these burdens?" (Congressional Globe, 282).

Thaddeus Stevens (1792-1868), chairman of the House Committee on Ways and Means, admitted that

"this bill is a most unpleasant one. But we perceive no way in which we can avoid it and sustain the government. The rebels, who are now destroying or attempting to destroy this Government, have thrust upon the country many disagreeable things. It is unpleasant to send your sons and your brethren to be slaughtered in this unholy war. It is unpleasant to send the tax gatherer to the door of the farmers, the mechanics, and the capitalists of the country to collect taxes for defraying the expenses of this war. But these things must come, or this Government must soon be buried in its grave. When we have to choose between these disagreeable duties; when the annihilation of this Government is the alternative on one side, no loyal man can hesitate which to choose" (Congressional Globe, 247).

After vigorous debate, the bill passed both houses of Congress and was signed into law by President Lincoln. According to the rules of apportionment, Washington Territory, with a population of fewer than 10,000 adults, would need to collect $7,755.33, while the more populous State of Oregon's assessment was $35,140.

First Federal Income Tax

Additional sources of federal revenue were still needed, and in an attempt to distribute the required new taxes more equitably several legislators drafted a bill to tax personal income for the first time in the history of the republic. One of its proponents suggested that an income tax "would be the most just, and undoubtedly the most popular, if any tax can be popular" (Congressional Globe, 248).

The resulting statute imposed a 3 percent tax on annual incomes over $800 for the year 1861, with payment due by the end of June, 1862. Since only about 3 percent of the population earned more than $800 per year, most citizens would be exempt from the new tax. This particular tax was never levied, however, for before the payment date arrived, Congress was preparing a more comprehensive measure to go into effect in 1862.

Taxing the Territory

As far as the direct tax was concerned, R. M. Walker (b. 1821), the auditor of Washington Territory, wrote to Secretary of State William Seward (1801-1872) that the territory could be counted on to pay its share:

"The citizens of this Territory have expressed their gratification in being afforded an opportunity of contributing their quota in sustaining their government and strengthening its hands in putting down the present gigantic and monstrous rebellion" (Roberts, 57).

In his address to the legislature of Washington Territory in Olympia in December, 1861, Acting Governor L. Jay S. Turney (1820-1881) spoke of the need to pay the direct tax: "Both patriotism and pride require us to meet that call promptly" (Messages, 97). He encouraged the lawmakers to assign territorial officials to collect the tax, thereby saving the taxpayers of the territory the 15 percent that would be charged by federal collectors. "The adoption of this suggestion," Turney continued,

"will secure for you the confidence and respect of our Government, and will be proof that you understand and appreciate the important and peculiar relation existing between Territorial Legislators and the General Government, and will command for your memorials and request, respect and consideration" (Messages, 98).

During its subsequent session, the legislature adopted Turney's suggestion, instructing the territorial auditor to oversee the collection of the required tax. The existing territorial bureaucracy of county auditors would assemble assessment rolls of real property, then the territorial auditor would apportion the amount due from each county. However, when the time came to forward funds to the treasury, county officials had managed to collect only $4,268, about 55 percent of the territory's quota.